Meet Dave and Allison.

They both work 40 hours per week.

Spend a day in the life of a hard-working Minnesota family who is struggling to make ends meet. Along the way, you’ll encounter how the five key elements of poverty can stand in the way of true self sufficiency. Poverty is not an emotion, state-of-mind, or choice. Poverty is an everyday reality. How will you make a difference in your neighbors’ lives?

Meet Dave and Allison.

They both work 40 hours per week.

Meet Carter.

He is in 4th Grade at public school.

Meet Emily.

She is enrolled in preschool.

Both adults earn a minimum wage of $10.59 per hour.

That’s $44,054 gross income per year.

This household income is more than the federal poverty line for a family of four, which is $30,000.

Average fair market rent for a 2-bedroom unit in Northeastern Minnesota is $1,027.

Annual cost:

Food for a family of four in Northeastern Minnesota costs around $1,054 per month.

Annual cost:

Emily’s preschool average is around $616 a month, enabling both Allison and Dave to work.

Annual cost:

Dave has employer-sponsored family health care. The monthly premiums are $621 per month.

Annual cost:

Energy costs for Minnesota families average about $177 per month.

Annual cost:

Having accounted for housing, food, childcare, health insurance, and energy costs, our working family of four, who is above the federal poverty line, only has $2,114 remaining each year, or about $176 per month, to meet other needs, such as:

| Housing | $12,324 |

| Food | $12,648 |

| Child Care | $7,392 |

| Medical Premium | $7,452 |

| Energy | $2,124 |

| Total Annual Expenses | $41,940 |

| Total Annual Household Income | $44,054 |

| Total Annual Expenses | $41,940 |

| Remaining for Basic Needs | $2,114/year or $176/month |

Poverty is often the result of ongoing instability and limited access to resources. Many families living paycheck to paycheck have little to no financial cushion. As a result, just one unexpected event, such as a medical expense, car repair, or job disruption, can push them into debt.

When a family is forced to take on debt to meet basic needs, it can become extremely difficult to recover. High interest rates, missed work, and rising costs can quickly compound, pulling households further into the cycle of poverty. This cycle makes it harder to rebuild savings, plan for the future, or respond to the next emergency, creating ongoing financial stress and insecurity.

Understanding poverty means recognizing how fragile financial stability can be, and how a single setback can have long‑lasting effects without support, resources, or opportunity.

There are five key factors that impact poverty:

When there is struggle in any one of these areas, other areas in a person’s life may suffer. Together, these elements highlight the interconnected nature of poverty and the need for wrap-around solutions.

Minimum Wage in Minnesota

As of January 1, 2023 the minimum wage for large employers in Minnesota is $10.59 and $8.63 an hour for small employers (MN Dept of Labor).

Educational Attainment

In 2023, 5.8% of Minnesotans had educational attainment less than a high school diploma, and 23.3% had a high school diploma or equivalent. With each level of education completed and more skills developed, the more access a person has to higher paying occupations. The percentage of Minnesotans with less than a bachelor’s degree was 61.1% (US Census Bureau).

Food Insecurity:

The state of being without reliable access to a sufficient quantity of affordable, nutritious food.

* The release of the Household Food Security in the United States in 2022 report and corresponding statistical supplement will be on October 25, 2023, due to updates to the survey instrument that were implemented for the first time in 2022.

Health Insurance Coverage

In 2022, 251,824 Minnesotans did not have health insurance coverage (US Census Bureau American Community Survey).

Housing and Energy

What happens when your housing is unaffordable, affordable housing does not exist, or you face the choice between rent and food? What if you’re one paycheck or emergency away from eviction? In the worst case, you could be homeless. In many other cases, you will likely have to settle for substandard housing, including a home that is energy inefficient.

Even with stable housing, there’s a strong correlation between homeownership and wealth. Young adults’ homeownership rate increases with household income. This effect is compounded by parental homeownership status. Income disparities also perpetuate disparities in housing.

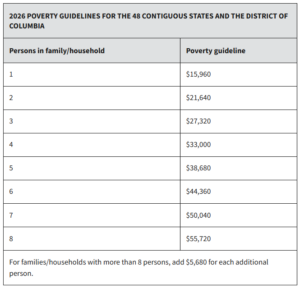

The poverty guidelines are determined by the Department of Health and Human Services and updated annually. The amounts are based on number of persons in a family per household. For families or households with more than 8 persons, an amount is added for each additional person.

2026 Federal Poverty Guidelines

The current official poverty measure was developed in 1963 and is based on the cost of the minimum food diet for various family sizes in today’s prices multiplied by 3. This official poverty calculation does not take into account the value of federal benefits, such as those provided by the Supplemental Nutrition Assistance Program (SNAP), and housing and energy assistance. Neither does it account for typical household expenses such as work expenses or childcare.

Supplemental Poverty Measure

The Supplemental Poverty Measure considers family resources, such as income, along with benefits including SNAP, subsidized housing, and the Low-Income Home Energy Assistance Program (LIHEAP).