Tax Assistance

Tax Credit Lunch and Learn

Join us for a free information session with a tax professional from Walker, Giroux, & Hahne LLC. Enjoy a free lunch, learn about valuable tax credits you may qualify for, and get your questions answered by an expert. This event is open to the community and is able to be attended in person or virtually.

Date: January 29th, 2026

Time:12:00-1:00PM

Location:AEOA Basement Conference Room or Virtually Here Meeting

Availability: St. Louis County

Program Description: Through our Tax Assistance Program, certified AARP Tax-Aide Program volunteers are available February 1 through April 15 each year to prepare Minnesota and federal tax forms for low- to-moderate-income individuals and senior citizens throughout Lake and St. Louis County.

Eligibility: AARP Foundation Tax-Aide provides in-person and virtual tax assistance to anyone, free of charge, with a focus on taxpayers who are over 50 and have low to moderate income. An AARP Membership is not required.

Appointment is Required:

All appointments must be made online. AARP Tax-Aide located will begin accepting appointments mid-January each year, with sites opening in early February. Book an appointment at a tax site using the buttons below.

Appointment Expectations:

New Information

- The IRS will not be mailing out refund checks and they are moving to not accept checks for payment. Bring with you, your routing and account numbers for refunds or payments so these can be done electronically.

- If you want Tax-Aide to file the MN Property Tax refund you should make your appointment after March 15 or make an appointment to have this filed before leaving the site. Appointments are being accepted for April 16 in the morning for MN Property Tax refunds. Do not make an appointment during the tax season to have your property tax refund done. There is a limited number of appointments. You need to bring your Appointment Reference number with you to your appointment.

- The appointment time is for you to deliver your documents to a counselor at the tax site. We ask that you stay near after you have dropped off your information.

- Once the return is complete you will be asked to return to finish the process.

- Intake forms are required and must be completed before your appointment. Forms are available at tax sites and Aurora, Gilbert, Eveleth, Mt. Iron, and Virginia libraries.

- All tax documents need to be OPENED and placed in the following sequence: Identification, Income, Deductions/Credits.

- No taxpayer documents will be held beyond closing time.

- Any taxpayer documents not picked up by the end of the tax season will be destroyed.

Documents Needed:

Get started and find out what documents you will need to help prepare your tax return with regards to income, payments, deductions, adjustments, credits, health insurance, etc. before your appointment.

File on Your Own

Taxpayers may now utilize one of our Chromebooks available at tax sites. You will set up a TaxSlayer account to complete your tax filing. This option is ideal for taxpayers who can navigate the process independently.

Tax Credits:

Credits reduce the taxes you owe. Both refundable and nonrefundable credits can reduce your tax to zero. If your refundable credits exceed the tax you owe, it can create a refund on your tax return. Several tax credits you may be eligible to claim are listed below. Questions? Call 651-296-3781 or 800-652-9094 or visit the Minnesota Department of Revenue website.

Child Tax Credit

Beginning with tax year 2024, you may qualify for a Child Tax Credit of $1,750 per qualifying child, with no limit on the number of children claimed. This is a refundable credit, meaning you can receive a refund even if you do not owe tax.

If a qualifying child is over age 17, you may not claim them for the Child Tax Credit. You may be able to claim the child for the Credit for Qualifying Older Children.

The credit gradually phases out if your income is over $31,950 or $37,910 for Married Filing Jointly. For more details, see the chart of Who Qualifies, below.

Advance Payments of the Child Tax Credit

Beginning with tax year 2024, you can choose to receive part of your Child Tax Credit for the next year in three advance payments before you file your next income tax return. For details, visit Advance Payments of the Child Tax Credit.

Child Tax Credit | Minnesota Department of Revenue (state.mn.us)

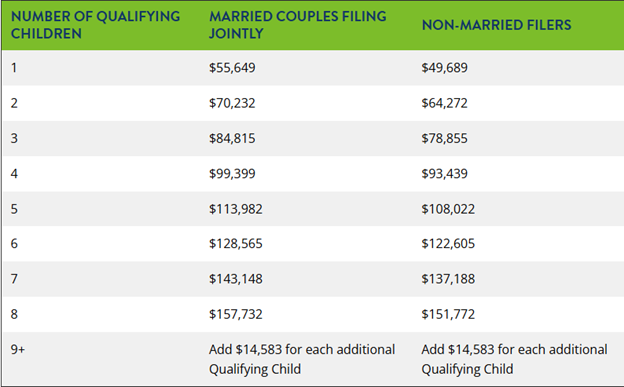

The Minnesota Working Family Credit is available to Minnesotans who earned income during the year and can provide a refund even if you do not owe tax. This credit depends on several factors and the amount you are eligible to claim may change if you have children, dependents, are disabled, or meet other criteria. The credit phases out at $37,910 if married filing jointly or $31,950 for any other filing status.

Working Family Credit | Minnesota Department of Revenue (state.mn.us)

Get relief for your rent or property tax! If you’re a Minnesota homeowner or renter, you may qualify for the state’s property tax refund. The refund provides property tax relief depending on your income and rent or property taxes. This refund is now available to those with Individual Taxpayer Identification Numbers (ITINs).

Reminder for Renters!

Starting in 2024, you claim and get the Renter's Credit as part of your income tax return. You no longer file a Renter’s Property Tax Refund return (Form M1PR). For details, visit Renter’s Credit.

Property Tax Refund | Minnesota Department of Revenue (state.mn.us)

Minnesota has two programs to help families pay expenses related to their child’s kindergarten through 12th grade (K–12) education: the K–12 Education Subtraction and the K–12 Education Credit. Both programs lower the tax you must pay and may even provide a larger refund when you file your Minnesota income tax return.

The amount of your subtraction or credit is based on the actual qualifying expenses you paid during the year for your child’s K–12 education - for which you have documentation (save your receipts)- up to the maximum amount allowed.

K–12 Education Subtraction and Credit | Minnesota Department of Revenue

Tax-Aide Volunteers:

Tax-Aide volunteers are trained and IRS-certified every year to make sure they know about and understand the latest changes and additions to the tax code. If you're passionate about making a difference and want to lend a hand, sign up for this rewarding volunteer opportunity! Whether you're a tax whiz or eager to learn, your contribution can make a real difference in our community. Basic computer skills are required, and we will provide all the training you need.

Contact:

218-288-1187

Please leave a brief message.

This service is sponsored by and made available through:

![]()

![]()